Table of Content

Before you apply for any type of loan, you should know your credit score and why it matters to help you find lenders that will work for you. Here are some details about the most common types of loans and the loan calculators that can help you in the process. The down payment is the money you pay upfront to purchase a home. The down payment plus the loan amount should add up to the cost of the home.

In rare cases, lenders may loan up to 5 times the borrower’s annual salary. However, regulatory restrictions limit banks to having no more than 15% of their mortgage loans above the 4.5x multiple. In these cases, lenders can be selective and only choose borrowers with low debt loads that can afford a substantial deposit.

Upfront costs

Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living. A secured loan requires the borrower to put up an asset as collateral to secure the loan for the lender. If you don’t make your car payments, the lender will repossess the car. Closing costs for a home buyer are typically 2% to 5% of the purchase price of the home.

Most lenders require that applicants have a credit score of at least 660 to qualify for unsecured home improvement loans. Borrowers with a score lower than 660 may still be able to qualify for a secured home improvement loan. However, interest rates, loan terms and available loan amounts are less competitive for borrowers with low credit scores. Home improvement loan funds can be used for a variety of projects, including home additions, repairs and renovations. This type of financing often comes in the form of an unsecured personal loan, with options available through online lenders, traditional banks and credit unions. However, home improvements also can be financed with a home equity line of credit , home equity loan or cash-out refinance.

Unsecured Home Improvement Loan Options

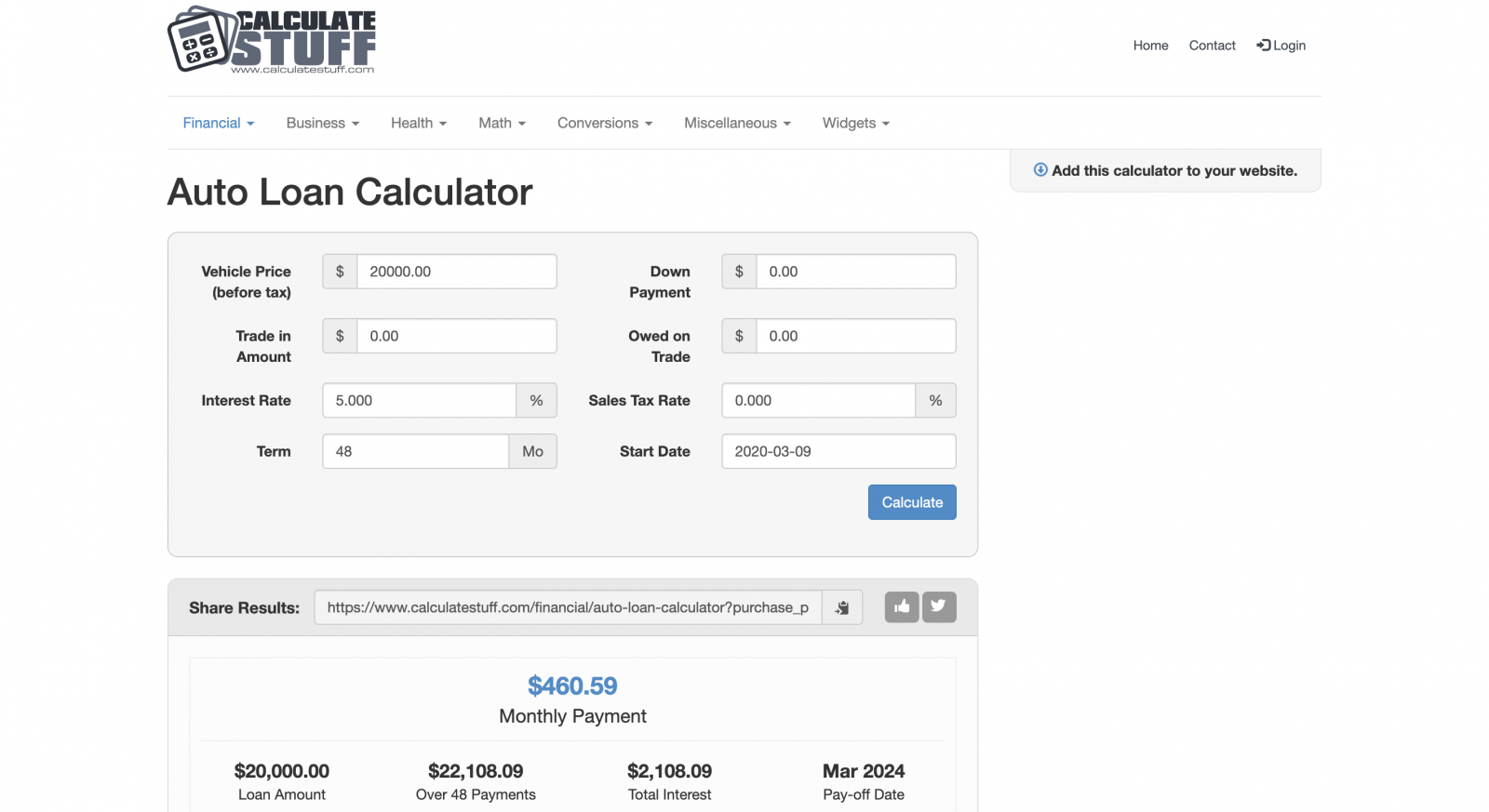

The portions of the monthly payment that reduce the amount you owe and the cost of borrowing . Input the various variables in the corresponding boxes for the principal, interest, and total life of the loan. The calculator will give you an answer for the total cost over the life of the loan. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment at competitive rates.

Buyers across the UK rushed to take advantage of the stamp duty holiday. According to data from the Bank of England, mortgage approval drastically increased especially after the initial lockdown. In 2021, roughly 9 in 10 buyers are expected to pay no stamp duty at all. The average stamp duty bill is anticipated to decline by £4,500. Use our mortgage affordability qualification calculator to estimate how much you can qualify for based on your current income. In addition to ongoing fees, there can be hidden home loan fees like discharge fees if you switch to a different home loan.

Home Improvement Loan Calculator: Find Your Renovation Cost

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. This allows you to see how changing rates can impact your monthly payments. You can compare interest-only payments and fixed-rate loans side by side.

Central banks have been having interest rates pegged at the lower bound, and some even employ negative interest rates. As fiscal intervention picks up, rates are likely to head higher eventually. In the above A vs. B example comparison, the fee for buying the lower rate was not rolled into the loan.

Guarantor Loan Calculator

SURF offers an option where the repayment schedule is linked to the expected growth in your income. You can avail a higher amount of loan and pay lower EMIs in the initial years. Subsequently, the repayment is accelerated proportionately with the assumed increase in your income. It considers the principal amount, quarterly compounded rate of interest and the number of periods for computation. There may be other costs such as repairs to the property, renovations, hiring a removalist and council / council/water adjustments. You should discuss the costs of buying a property with your conveyancer.

Only 1 in 50 mortgages come with a fixed rate longer than 5 years. Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month. Calculate the total cost over the life of a car loan with this Total Cost of Car Loan Calculator.

This allows you to focus on comparing the difference in interest rate and total interest paid against the upfront fee for buying access to a lower rate. The decrease should be seen as the beginning of market normalising after the COVID-19 housing boom. When normal housing demand resumes, the mortgage industry should eventually process applications again more inline with regular historical levels seen from the 2014 to 2019 time-frame.

For example, if a home has a $400,000 mortgage balance and is worth $700,000, the homeowner could refinance for $450,000. In this case, they would take home $50,000 in cash after paying off the old loan balance. Click here to see our full line of mortgage calculator embed options.

While shopping for any loan, it’s a good idea to use a loan calculator. A calculator can help you narrow your search for a home or car by showing you how much you can afford to pay each month. It can help you compare loan costs and see how differences in interest rates can affect your payments, especially with mortgages. The right loan calculator will show you the total cost of a loan, expressed as the annual percentage rate, or APR. Loan calculators can answer a lot of questions and help you make good financial decisions. Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees.

This calculator reveals the financial impact of these variables along with an amortization schedule. Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. Interest rate is the percentage of a loan paid by borrowers to lenders. For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both interest and fees.

What is a Home loan and how does it work?

Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. Be sure to make qualified overpayments to avoid this extra cost. If you know the interest rate you’ll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. Falling rates gave buyers with tracking rates less incentive to refinance as their loan already tracks rates lower.

No comments:

Post a Comment